In todays volatile world, the recent plummet of Silvergate ($SI) has sent shockwaves through the market. With a staggering 46% drop in value, the question on many investors’ minds is what happens if the bank goes belly up? This concern is further compounded by the recent actions taken by other major players in the industry, such as Kraken and Coinbase. As the fate of Silvergate hangs in the balance, many are left wondering about the potential impact on other cryptocurrency-backed stablecoins.

Silvergate & USDC

One of the biggest concerns in the wake of Silvergate’s dramatic drop is the potential impact on USDC, one of the most widely used cryptocurrency-backed stablecoins in the market. With Silvergate being one of the financial institutions holding a portion of USDC’s backing assets, investors are left wondering whether this puts USDC at risk.

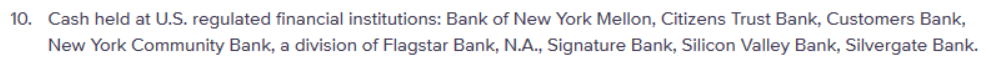

Upon closer inspection of USDC’s audit report, it is revealed that Circle, the company behind USDC, holds a staggering $10 billion across 10 different financial institutions, including Silvergate. However, there is no clear breakdown of how much of that $10 billion is specifically held at Silvergate, leaving investors uncertain about the potential risks.

In an effort to ease concerns, Circle has taken to social media to distance itself from Silvergate and reassure investors of USDC’s stability. Nonetheless, the uncertainty surrounding Silvergate’s future and its impact on USDC underscores the inherent risks in the cryptocurrency ecosystem.

“We maintain relationships with several banking partners. We are sensitive to the concerns around Silvergate and are in the process of unwinding certain services with them and notifying customers. Otherwise, all Circle services, including USDC are operating as normal.”

Silvergate & GUSD

The fallout from Silvergate’s could not just limit itself to USDCalone. Gemini Dollar (GUSD) may also be facing potential risks, as it appears to be less diversified than its stablecoin colleague. While the specifics of GUSD’s cash reserves allocation remain unclear, it is known that GUSD is only spread across three banks, namely Silvergate, State Street, and Signature banks.

This lack of diversification means that if a significant portion of GUSD’s assets are held at Silvergate, GUSD may be more vulnerable to the potential fallout of Silvergate’s decline. Investors can access GUSD’s official report to gain a better understanding of the situation.

As the situation continues to develop, we will have to wait and see how Silvergate responds and how the market reacts to these events. The ongoing uncertainty highlights the importance of due diligence when investing in cryptocurrencies, especially when it comes to stablecoins.

The post Silvergate FUD: Is GUSD – Gemini Dollar in Danger? appeared first on YourCryptoLibrary.

Wil je op de hoogte blijven van het laatste nieuws? Abonneer je dan op onze push-berichten op Telegram of Twitter.

Heb je vragen of wil je in contact komen met andere crypto fanaten join dan onze Telegram chat!