Executing a limit order on decentralized exchanges seemed unachievable for as long as we can remember. We just had to time it right and hope the market moved in our favor from then on. But as time progressed, so too did the trading interface.

With the Uniswap limit order we can set our orders and go touch grass, as the Uniswap founder puts it so nicely.

In this guide will walk you through setting up a limit order on the Uniswap web app, and ensure you can execute trades at a price that works for you.

What Is a Limit Order on Uniswap?

A limit order on Uniswap allows specifying the exact price willing to buy or sell a token. Unlike market orders, which execute at the current market price, a limit order remains open until it can fill at the specified price, unless cancelling it, or with insufficient funds, or it expires. Sounds intriguing, right?

Difference Limit Order and Traditional Swap

The primary difference between a limit order and a traditional swap lies in trade execution. A traditional swap executes immediately at the current market price, while a limit order waits for a filler matching the specified price before the swap occurs.

Understand real traders solely work with limit orders.

Where Do Your Limit Orders Go Once Created?

After setting up your limit order, it does not just sit idle. It’s sent into a pool of open orders, available to an open network of third-party fillers on UniswapX. This means the order may fill from any scanning fillers matching orders. Similar to an order book, but not as transparent or easily visualized as a classic centralized exchange order book.

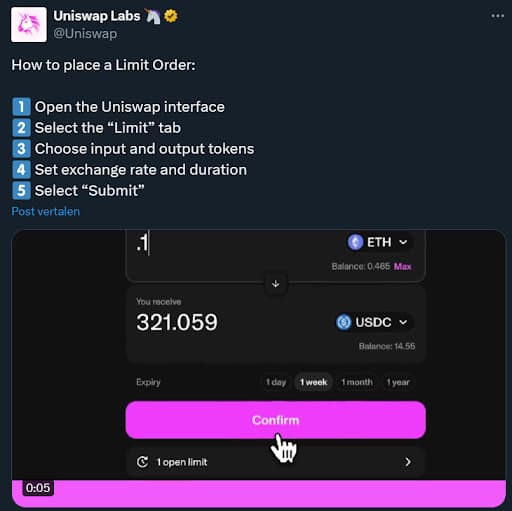

How to set Limit Orders on Uniswap Guide

When creating a limit order, needing specify the following:

- The amount of tokens wanting swap.

- The tokens paying with and the ones wanting to receive.

- The price wanting the swap occurs.

- The expiry, which is the time frame the limit order is active.

These are crucial in order to have the best overview possible. Please note the limit order, a new thing in the decentralized space and much finetuning needed.

If you have the right conditions in mind, then proceed to the following step.

- Manually enter the amount wishing to pay or receive, or utilize the “Max” option to automatically fill the total available amount of the token in your wallet.

- Enter the price wanting your limit order to execute at.

- Utilize quick options (1%, 5%, or 10%) to set a price a certain percentage above the current market price.

- Click “Submit order.”

- Review order details and select “Approve and swap,” incurring a network cost for approval if the first time swapping that token.

How Can You Set the Expiry for Your Limit Order on Uniswap?

Selecting when wanting the order to expire is possible. This is preferable when prices change rapidly and wanting it only for a brief timeframe in the ‘orderbooks’.

What if your Limit Order on Uniswap failed?

There is several reasons why your limit order may fail or not execute:

- High Network Fees: If the Ethereum network is congested, which tends to be the norm rather than the exception, the cost of executing the limit order may outweigh the benefits.

- No Available Match: Simply put, there may be no match willing or able to complete the swap at the agreed-upon price.

- Insufficient Liquidity: A lack of enough liquidity for the token prevents a match from carrying out the swap as it could move the price too much and impact their profits.

- Insufficient Token Balance: Your limit order will not execute as your wallet does not hold enough tokens to fulfill the swap. If this occurs, the limit order will fail and close without incurring a network cost.

Conclusion

What is important is that Uniswap offers limit orders. This can be seen as the first step in building a decentralized exchange that mirrors or even replaces a centralized one in the (near) future. What is not yet available is working with stop orders. Limit orders currently only work in one direction.

However, a limit order is a valuable tool for traders who want more control over their trading prices. By setting specific conditions upfront, we can better manage our positions. This is if you consider the insanely high gas fees that Ethereum mainnet still has.

The post How to Create a Limit Order on Uniswap: A Step-by-Step Guide appeared first on YourCryptoLibrary.