The post USDC Rises Towards $1 After Turbulent Weekend appeared first on YourCryptoLibrary.

USDC stablecoin has bounced back to 99.3 cents after plunging to a new all-time low of 87 cents due to Circle’s disclosure of $3.3 billion cash reserves sitting in Silicon Valley Bank.

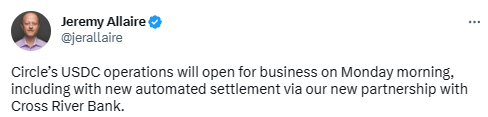

CEO Jeremy Allaire tweeted that USDC reserves are secure and that liquidity operations will resume as soon as US banks open on Monday. Circle will transfer the reserves to BNY Mellon, and Allaire reassured customers that deposits from SVB were secure and accessible when banking opened. The announcement comes after the seizure of Signature Bank and SVB, but Allaire maintained that USDC reserves were safe and secure.

Although the New York Department of Financial Services seized Signature Bank and Silicon Valley Bank, federal officials have confirmed that all customers at both banks will have access to their deposits. If you are not certain about the survival of USDC stablecoin, it might be a good idea to consider shorting or hedging your position. With recent news about banks being seized and USDC reserves being transferred, there is uncertainty in the market.

You can short USD Coin – USDC on a futures market on MEXC Global. This is a market where you buy/sell a contract, which specifies when and at what price the token will be sold. If you sell this futures contract, it suggests a prediction that USD Coin – USDC will decline in price. You can short USD Coin – USDC with contracts that bet on a lower price for the token.

The post USDC Rises Towards $1 After Turbulent Weekend appeared first on YourCryptoLibrary.